Blog

You filed an annual income tax return, only to find out some time later that you are being audited by the Internal Revenue Service. The prospect is daunting for many people, and understandably so. It is not the end of the world, though, especially if you are prepared. The two most important preemptive actions you can take are entirely within… Read More

You compiled all the necessary documents, tallied a year’s worth of income, searched for deductible expenses and filed your annual income tax return on time, only to receive a tax notice in the mail some time later from the Internal Revenue Service. Do not worry; there is no need to panic. A tax notice does not automatically mean you are… Read More

You have compiled all the necessary documents, poured over a year’s worth of income and expenses, and managed to file your annual tax return on time. Even better, the Internal Revenue Service accepted it. Although none of us want to consider it, what happens if there is a mistake? Maybe you received additional tax documents after you already filed the… Read More

Tax Day is just under one week away. Many people, however, are yet to file their 2018 tax returns with the IRS. While this can be a stressful situation, it does not have to be. With the proper preparation and organization, you can still timely file your tax return before the April 15th deadline. To help you accomplish this, we… Read More

The deadline to file your income tax return is fast approaching, as April 15th is just five weeks away. If April 16th arrives, however, and you have yet to file your tax return, you may be worried about the penalties that you may be subjected to by the Internal Revenue Service (IRS). If you do miss the deadline, do not… Read More

Tax season began on January 28th this year, and many of us have already started the process of gathering the necessary information to file our returns. We may pay taxes every year, but that does not mean it is a simple process. Did you know that making small errors while filing can add up to costly mistakes? Complying with tax… Read More

When your loved one has special needs, you know that there are many unique challenges you face that many others have never thought of before. Disability manifests in different forms for different people. Our experience has shown us throughout the years that no one case is identical to another, but that individuals with special needs need help from their loved ones,… Read More

Do you believe that you have ever experienced a “mental fog” or disorientation after taking certain medications, like antihistamines? While it may be a normal side effect, it can also come with long-term risks not previously known to scientists. According to several landmark studies in recent years, certain categories of drugs known as anticholinergics and benzodiazepines have been linked to elevated risks of… Read More

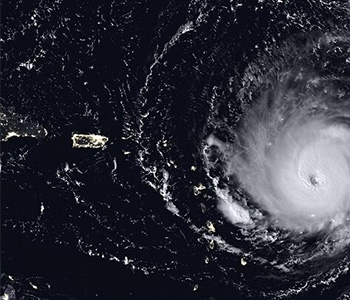

Preparing for a hurricane doesn’t just mean securing your home or relocating from the area in advance of an oncoming super-storm, it also means knowing what to do after a hurricane passes. There’s a lot more to it than simply cleaning up yard debris and waiting for your electricity to be restored, if necessary. It can be an extremely hazardous… Read More

Earlier this year, the Tax Cuts and Jobs Act (TCJA) was signed into law and quickly began taking effect. As many of you may know, the new tax law brings significant changes to the future tax landscape, many of which differ for each of us. Despite these differences, there are some commonalities found within the tax law, specifically for parents,… Read More